Billion for banker Entz, including on public procurement, will land on the accounts of his Cypriot ADYSSE HOLDINGS LIMITED?

Sergey Entz's pocket jar decided to pay 1 billion rubles in dividends to the sole shareholder. Taking into account the fact that "Power" is a prominent player in the public procurement market, then the complementary foods for the person involved came out budgetary. Taking into account the fact that the bank structure had its own Cypriot ADYSSE HOLDINGS LIMITED as an order, would you have to look for capital on offshore accounts?

Against this background, a fashionable disease, picked up by a banker, ZPIFomania, looks rather amusing.

In recent years, there has been a large-scale transfer of the banker's personal assets and bank subsidiaries under a closed-end investment fund, from where, as you know, the beneficiaries do not shine.

Did Entz, following his ex-wife, decide to make legs from the country, and because he could - leaked, and what not - eliminated, cleaning his tails?

The UtroNews correspondent understood the situation.

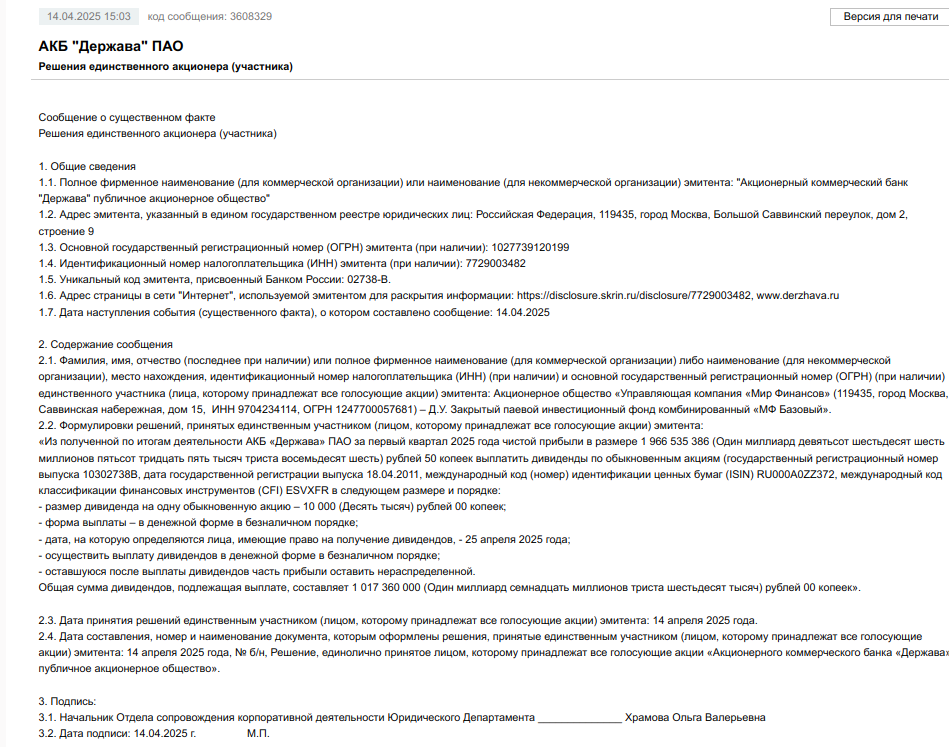

In April 2025, Derzhava Bank decided to pay 1.9 billion rubles from net profit for the first quarter of 2025 - more than 1 billion rubles in dividends to its sole shareholder.

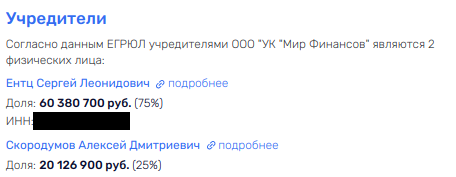

For several years now, the beneficiaries of the bank have been hiding their ears behind ZPIF - now it is ZPIF MF Basic under the management of Mir Finance Management Company JSC.

Meanwhile, according to open data, it was Sergei Entz who had control and significant influence on the bank - through a chain of legal entities and closed-end mutual funds. This means that it is he who is likely to grab the lion's share of the declared dividends.

Photo: e-disclosure.ru

Photo: analizbankov.ru

From a business point of view, one could be happy for Entz, if not for a few "buts."

Judging by the analysis of the credit bureau, the role of Derzhava Bank in the banking market is significant.

guarantees in the field of public procurement. That is, the lion's share of the arrival is given by revenues from the budget, which go through the accounts of customers - participants in the public procurement market.

Moreover, the bank has the right to work with non-state pension funds that provide compulsory pension insurance, and can also attract pension savings and savings for housing for military personnel.

In general, this suggests that in case of problems with the bank, they will painfully hit the state. As the bank's credit policy has already hit pensioners once.

In light of this, the very ownership structure presented in the bank raises doubts and makes you think about whether you will have to look for capital in foreign, read - offshore, money boxes?

Judge for yourself.

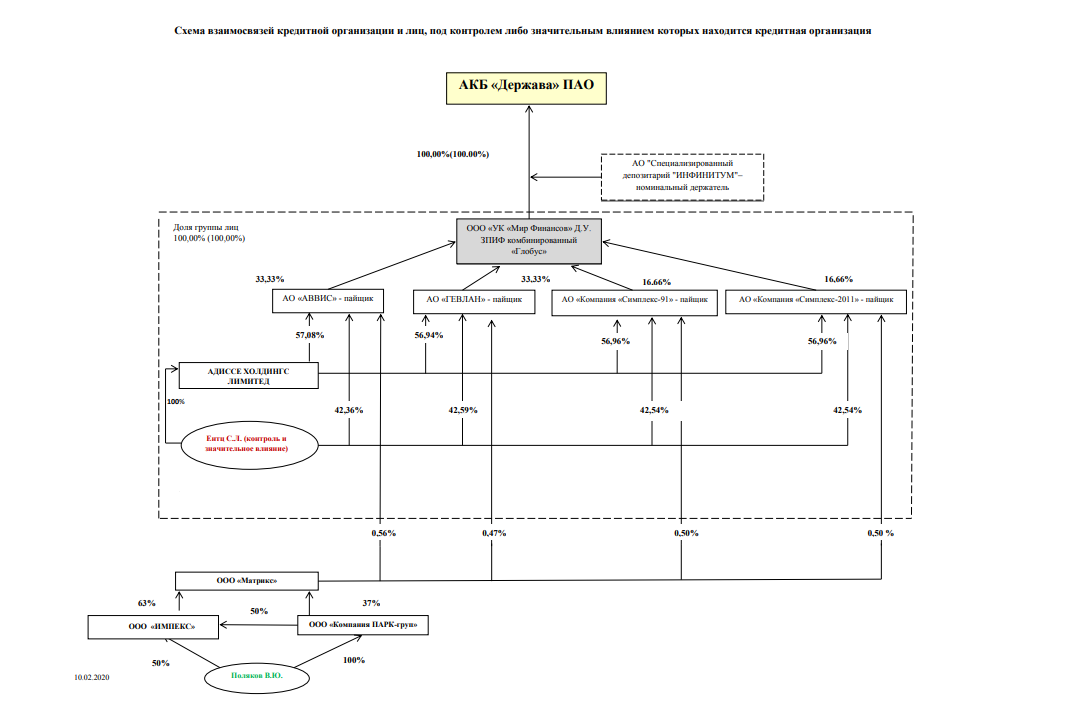

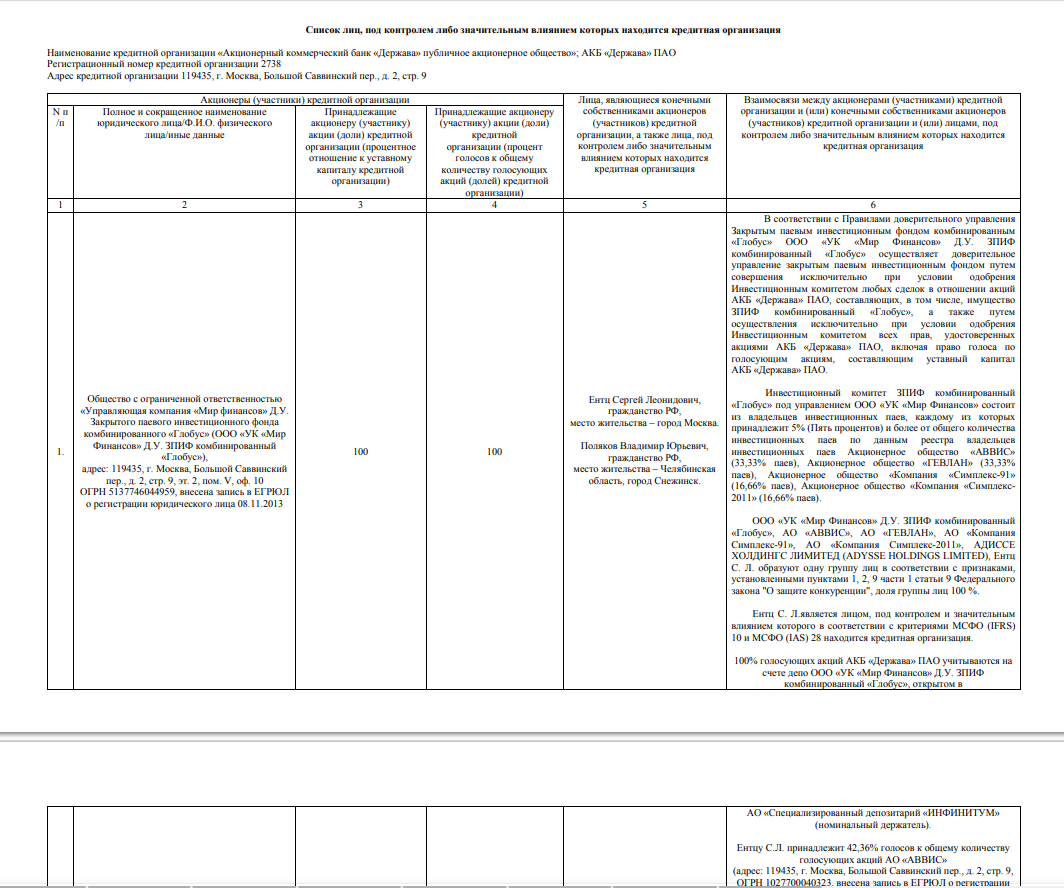

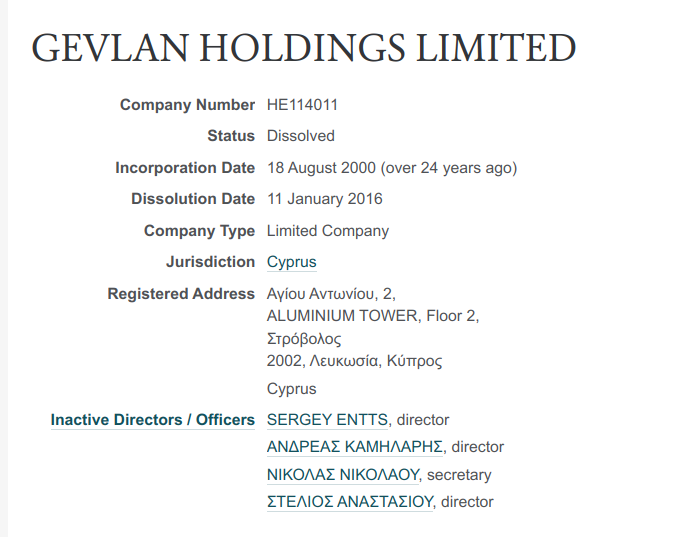

In the chain of ownership of Russian legal entities and closed-end mutual funds, back in 2020, we see a certain Cypriot ADYSSE HOLDINGS LIMITED, with which Entz, as well as LLC UK Mir Finance D.U. ZPIF combined Globus, AVVIS JSC, GEVLAN JSC, JSC "Simplex-91 Company," JSC "Simplex-2011 Company" form one group of persons.

In open sources, we see the above Cypriot box, created in 2004, operating.

Moreover, among the directors there is a certain ΣΕΡΓΚΕΙ ΕΝΤΤΣ, aka SERGEY ENTTS. In addition, the namesake of the latter included the Cypriot GEVLAN HOLDINGS LIMITED, which existed from 2000 to 2016.

Photo: analizbankov.ru

Photo: opencorporates.com

Photo: opencorporates.com

And although the credit bureau, when issuing the rating, stated that the financing of related parties is assessed as insignificant, for some reason Entz has been keeping the Cypriot legal entity active for the past almost 21 years, right? I wonder if you joke about the accounts of Cypriot firms, how many billions are there?

By the way, how can one not recall the story of Entz's wife (now former) - Alevtina Kalashnikova, ex-vice president and financial director of VIM-Avia.

Kalashnikova just the other day was sentenced in absentia to 8 years in prison with a fine of 900 thousand rubles. She was charged with abuse of authority, aiding in the illegal receipt of a loan and committing a foreign exchange transaction to transfer money to the accounts of non-residents using forged documents.

The lady was tried in absentia due to the fact that shortly before the visit of the investigators, she made her legs and, together with the owners of the airline, is on the international wanted list. Presumably, the lady is in the UK, from where they refused to extradite her.

The investigation believes that the defendants bought fuel at inflated prices from controlled companies and avoided fulfilling obligations to counterparties. In addition, in 2016, participants illegally received loans in the amount of 1.6 billion rubles from a commercial bank, presenting deliberately false information about the financial condition of the company.

The bank was not named in this story. Questions arose about whether the husband was involved in his wife's clever stories?

Moreover, the real estate that came under arrest in the Kalashnikova case formally belonged to him, but the investigation considered that the lady acquired assets with illegally received funds, and rewrote it to her husband, just so that they would not go under arrest. Then the Entz itself is not so white and fluffy?

And the investigation considers the divorce fictitious, claiming that in 2001-2017, up to Kalashnikova's flight abroad, they lived in the same apartment with their children. So, draw conclusions for what else could you need a Cypriot cube Entza.

And note that it was after this story that ZPIF began to love Entz's business.

By the way, in 2023, Entza was practically brought under the monastery by his associate, the deputy chairman of the bank Timur Nazyrov, who became a defendant in the fraud case and also made legs from Russia. He is also, like Kalashnikova, on the international wanted list.

The Bank of Entz also appeared in the high-profile case of the former Deputy Minister of Energy Tikhonov, who was burned out on corruption in the implementation of the GIS TEK project.

And it is very amusing against this background that castles look in Entz's business, which took place in 2024-2025: both in the bank's daughters and in Entz's personal assets. Castling hinted that the banker chose a closed format. And now, finding out who and whom, how much it credits, will be very problematic. After all, the assets were hidden behind the closed-end mutual funds, which, as usual, do not disclose the beneficiaries.

So, for example, such a bank company went under the closed-end investment fund and earlier - personally Entza as DP Tech LLC, which specializes in software development. How can you not remember Tikhonov's case, right?

This LLC-shka with a turnover of almost 1 billion rubles had a contract with the state-owned company Dom.RF, which brought 74.6 million rubles. The money was paid for access to the Power-Online system, which hints to us that this part of the bank's business was withdrawn under a separate cap. Moreover, the contract is listed as the one whose execution is terminated, which is very strange, in our opinion.

Let's move on.

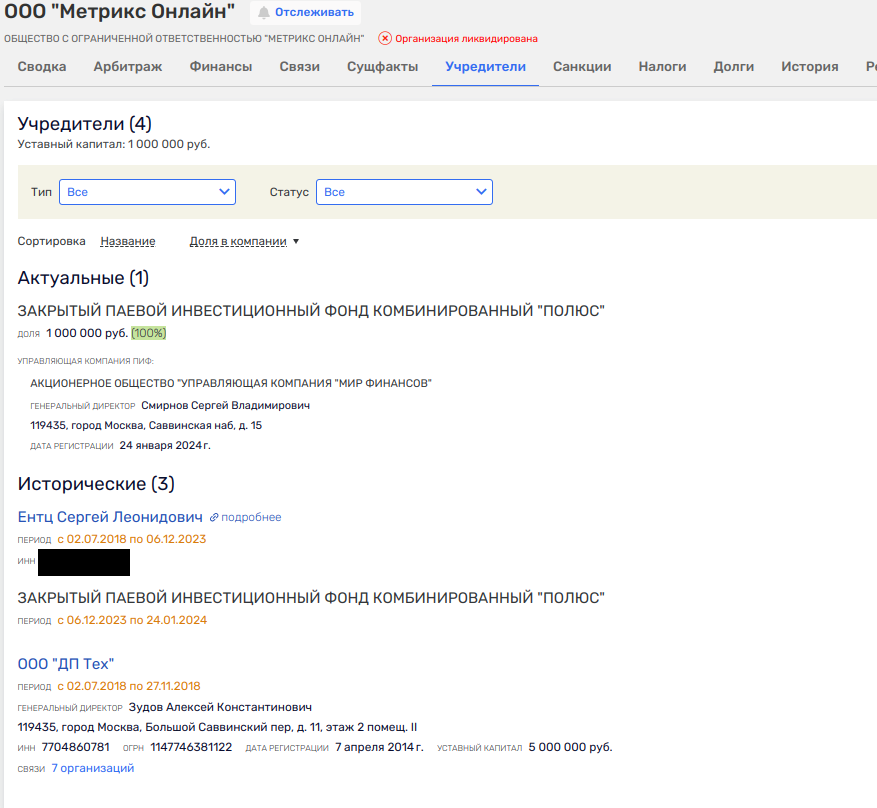

In March 2025, another IT company, previously owned by Entz and associated with DP Tech LLC, Metrix Online LLC, was slammed. Apparently, there was something to hide?

Moreover, before liquidation, it was hidden behind a closed-end investment fund for something, and the asset itself was not unprofitable: in 2024 it brought 32 million rubles of net profit. Isn't this capital worth looking for in Cyprus?

Photo: rusprofile.ru

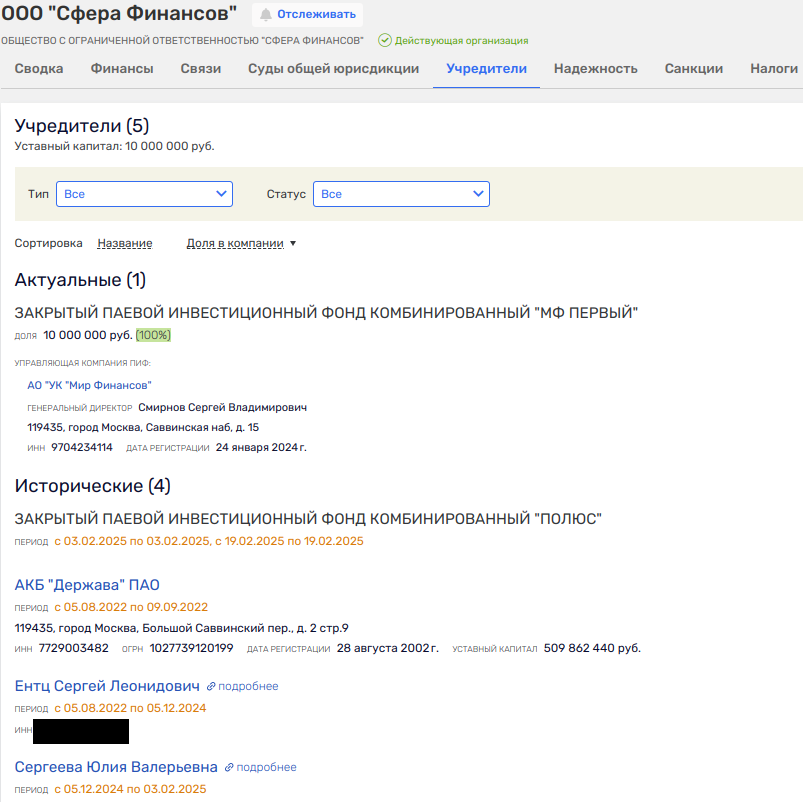

Even more interesting was thrown from hand to hand by Sphere of Finance LLC, whose predecessor was the same DP Tech LLC. In December 2024, Entz transferred the asset to Director Yulia Sergeeva, who, having held it for a couple of months, threw it to the closed-end investment fund. Mr. Entz, are you confused there like a hare?

Photo: rusprofile.ru

In addition, in August 2024, Finance-Management LLC was liquidated, which once belonged to the bank, and then passed from hand to hand and donkey with a certain Marina Anastasiu, a Cypriot who acted as the director of a whole pack of cubes. And her namesake has a director's chair in British firms. Was it just there that Entz's ex-wife rushed?

Other assets of the bank and personally Entza were transferred to the closed-end investment fund under the management of Mir Finance Management Company JSC, which was previously an LLC. And this LLC was controlled by Entz.

Photo: rusprofile.ru

Bank Derzhava is also interesting because, at least in 2023, it was a shareholder of PJSC Almar, a company where the wife of the head of Yakutia, Aisen Nikolaev, Lyudmila, has the lion's share. Nikolaeva's firm, despite multimillion-dollar losses, is actively credited by Almazergienbank, in which 87.37% of the voting shares belong to Yakutia, and the obligations of the shareholder are performed by the Ministry of Property of the Republic. The head of the latter is appointed by Nikolaeva's husband. What role Entza Bank can play in this loan scheme is not yet known.

In general, when a Cypriot box and a closed mutual fund appear in a bank that is of great importance for government orders, one investigator opens his eye somewhere. In general, in our opinion, where there is a place for budget interests, there is no place for offshore companies. Taking into account the course towards nationalization, no matter how much Entz had to answer the Prosecutor General, why did he need to keep the Cypriot ADYSSE HOLDINGS LIMITED on his balance sheet for 21 years.

And really, why?

.jpg?v1745556228)

.jpg?v1745556228)