Raiffeisenbank, which has recently managed to demonstrate an unfriendly attitude towards Russian clients, flew in a boomerang in the form of a lawsuit for almost 195 billion rubles and blocking of shares. It seems that the Austrian beneficiaries will have to pay dearly for trying to cheat.

A couple of years ago, Raiffeisen Bank International (RBI), which announced its withdrawal from Russian business, may be left with a nose - according to the claim of MKAO Rasperia Trading Limited, which was once associated with oligarch Oleg Deripaska, the shares of the Russian subsidiary were temporarily frozen. They cannot be sold until the claims are resolved. And this process can take many months, if not years.

The UtroNews correspondent understood the situation.

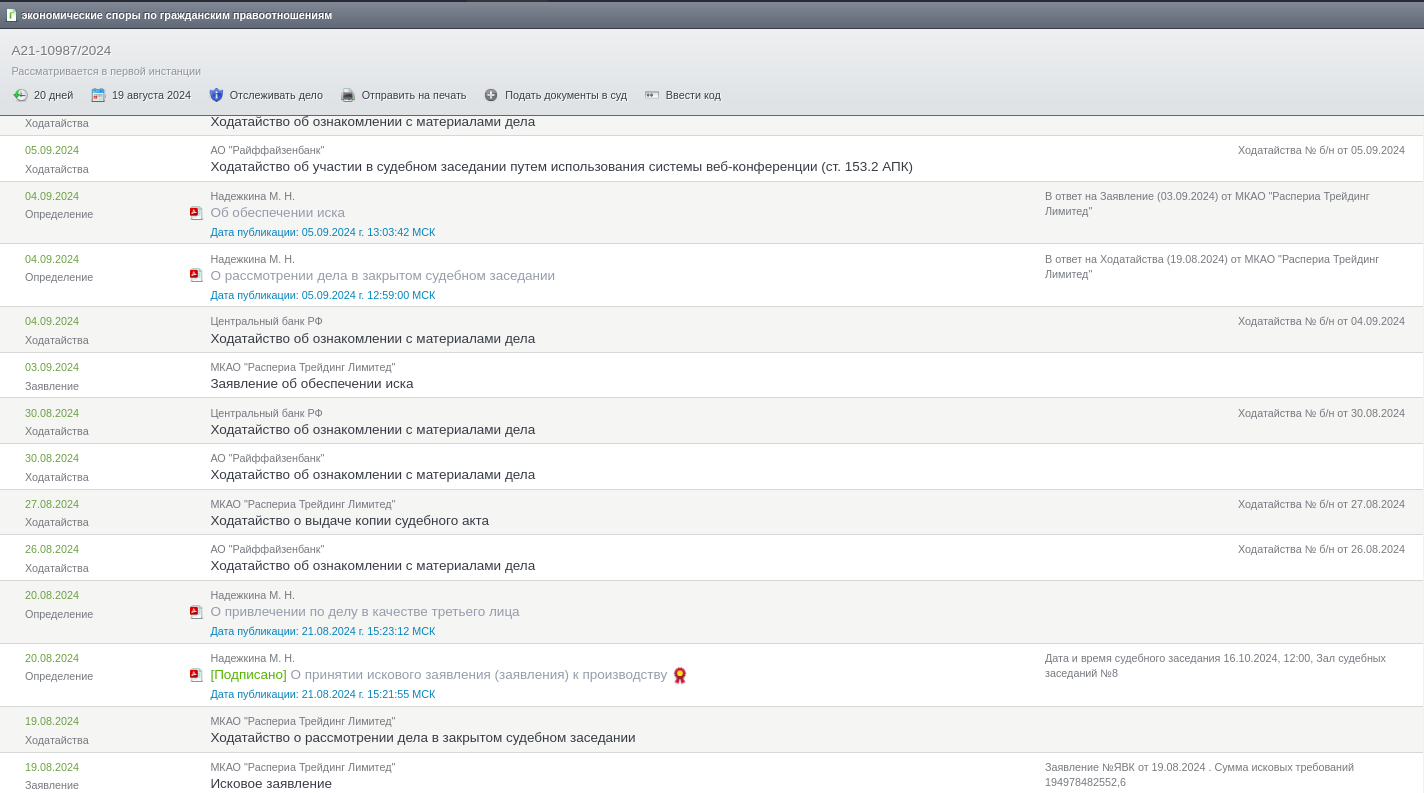

On October 16, the arbitration of the Kaliningrad region plans to begin consideration of the claim of MKAO Rasperia Trading Limited against Raiffeisenbank and a whole group of foreign companies and individuals, including the construction STRABAG SE.

The case is being heard behind closed doors, but it is known that we are talking about the recovery of almost 195 billion rubles and foreclosure. In the case, interim measures were imposed and a writ of execution was issued.

It is known from the message of Austrian shareholders that the shares of Raiffeisenbank JSC (Russia) were banned from transferring. It is clarified that the decision is connected with the claim of Rasperia Trading Limited, which recently changed its residence permit from Cyprus to Kaliningrad, in Russia against STRABAG SE, its main Austrian shareholders and Raiffeisenbank JSC.

Shareholders also noted that the lawsuit complicated the sale of the subsidiary asset and would inevitably lead to further delays. Experts have already expressed the opinion that RBI will not be able to sell the asset for at least six months, or even more, and then it may be necessary to make a significant discount.

Photo: kad.arbitr.ru

The lawsuit was based on a broken deal to buy a block of shares in the construction company Strabag, with which Oleg Deripaska's Basic Element holding collaborated during the Olympic construction years. It also included Rasperia Trading, which became the owner of about 25% (according to other sources - 27.7%) in Strabag.

It was this package in December 2023 that expressed a desire to buy Raiffeisenbank for about 1.51 billion euros. At the same time, it was planned to drive the purchase further according to a very cunning scheme - the asset was planned to be transferred by the Austrian shareholder in the form of dividends. But here's the nuance - such a deal must be approved by the Russian authorities.

When the deal was announced, the seller was closely associated with Oleg Deripaska, but later Strabag began to declare that Rasperia was not connected with Deripaska.

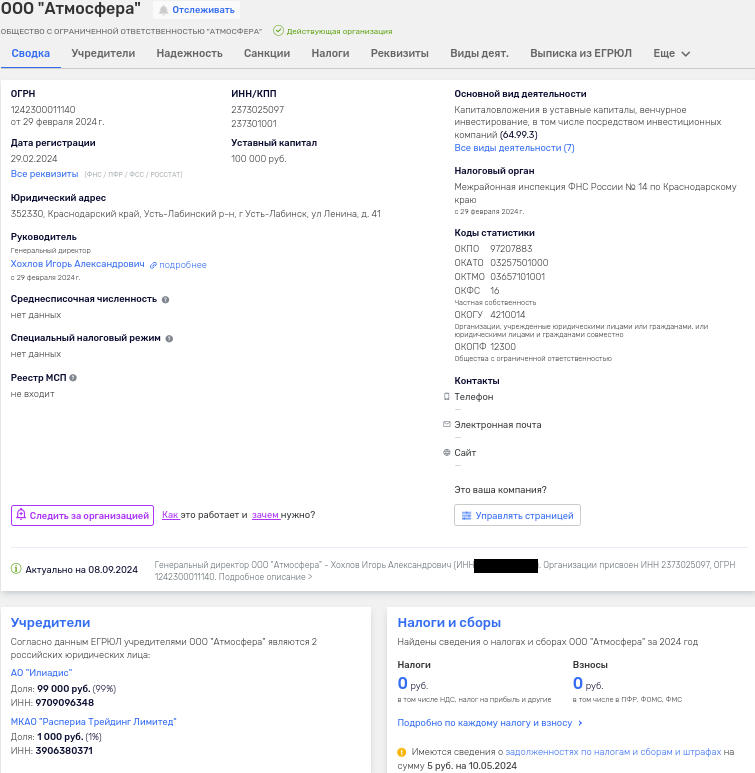

The Kommersant newspaper reported that Deripaska had notified the transfer of Rasperia to the Ilidias joint-stock company. The latter today does not disclose the beneficiaries, but meanwhile, Ilidias and MKAO Rasperia Trading Limited have had a joint subsidiary, Atmosphere LLC, since February 2024, which is registered in Deripaska's native Ust-Labinsky district of Kuban. So has he distanced himself from the assets as much as he wants to demonstrate?

Photo: rusprofile.ru

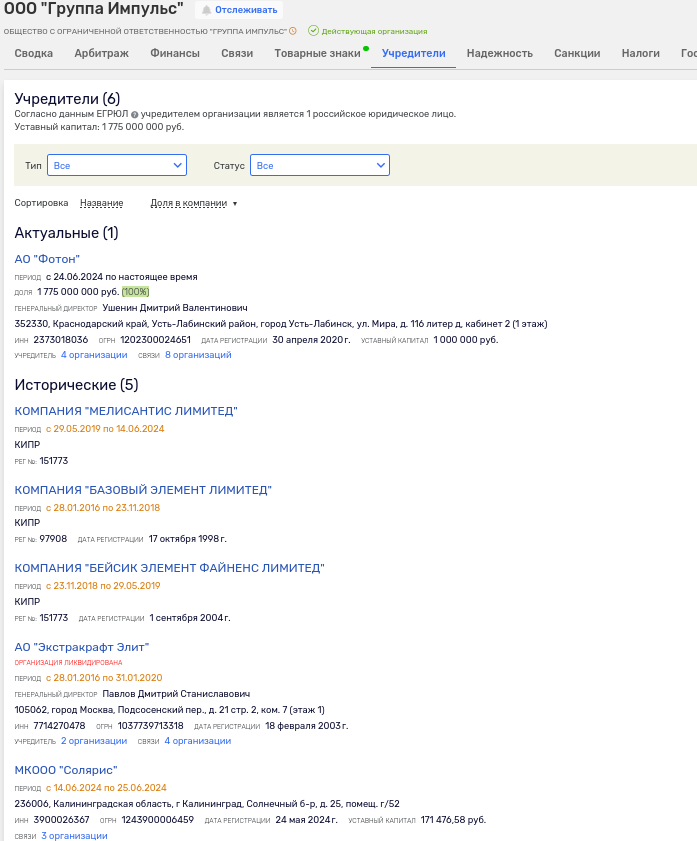

At the same time, we learn from the materials of another case that at least at the end of July 2024, the shareholder of Ilidias is a certain unprofitable Moscow LLC Title, which was created when Rasperia changed its residence permit from Cyprus to Kaliningrad. The company belongs to its own director - Dmitry Beloglazov, the full namesake of the founder and president of the international group of companies "Erich Krause." In May 2024, Beloglazov was included in the US sanctions list. justifying by the fact that he allegedly helped Deripaska in a deal related to Iliadis JSC and Rasperia.

By the way, Beloglazov appears in a certain Aelita JSC as a creator together with Oleg Vikhansky, who in turn was a co-founder of the Institute for Comprehensive Strategic Studies NP. In the institution of the latter, Impulse Group LLC also appeared, in whose biography Deripaska's "Basic Element" was noted.

By the way, among Beloglazov's partners in Krain Trading LTD JSC there is an offshore company with Seychelles - CRANE SERVICES LTD, whose beneficiary has not been disclosed. So, they may turn out to be anyone.

Photo: rusprofile.ru

But back to the Raiffeisen deal.

In May 2024, RBI announced that it had changed its mind about buying Rasperia's stake in Strabag, as it had not received guarantees from government agencies to continue the proposed transaction and "excessive caution forced the bank to abandon the transaction."

An interesting picture adds up. That is, the company, which announced the door slam two years ago, decided that it would be approved of an attempt to fill the mosh before this, followed by the withdrawal of the asset to Austria? What a wonderful naivety.

By the way, it is not a fact that the Austrian beneficiaries, accustomed to high profits from the Russian segment, would have left completely. So, in July, Interfax quoted the CEO of the Johan Strobl group, who stated that RBI "is most likely" to sell 60%, and retain 40% of Raiffeisenbank. Apparently, they decided not to cut the chicken carrying golden eggs at once: according to the Financial Times, the Russian daughter accounted for 40-50% of all payments between Russia and the rest of the world. Even the sanctions did not frighten the fans of the ringing coin. Apparently, Austrian businessmen have already agreed with European and American politicians on this matter?

Earlier, UtroNews already told what Raiffeisen was doing before the planned departure from the Russian market and how much this behavior sometimes does not fit into the outline of conscientious relations with clients (according to the latter). So, in particular, after rumors about the possible transfer of the RBI subsidiary to Sberbank, customers began to block accounts without explanation. At the request of UtroNews, the management, represented by Sergei Monin, chose to remain silent, not even responding to claims of possible violations of the rights of the bank's clients.

An analysis of the situation in the bank, conducted by the editors, showed some interesting facts. For example, it turned out that in recent years 33 violations have been identified in Raiffeisen, and claims from clients have been blocked in the courts, and claims for the protection of business reputation. In general, the JSC was a defendant in 2549 cases in the amount of 3.5 billion rubles, including challenging loan agreements.

Photo: rusprofile.ru

There were claims against the bank from bailiffs, as well as labor inspections - for example, in August 2024, the bank was warned about the inadmissibility of violations of labor legislation, and earlier it was threatened with a finger at the inadmissibility of violating the procedure for assigning the minimum wage in the region. What's the petty economy, Mr Monin?

It also turned out that for a number of indicators of financial stability, the bank had a decrease in indicators in different reporting periods. For example, the level of total capital adequacy was labeled "satisfactory," but the trend, according to experts, was "negative."

Also in 2023, the FAS caught Raiffeisen on inaccurate advertising and ordered to improve. That is, customers also brazenly lied?

Meanwhile, the management, represented by the same Monin, is simultaneously engaged in personal business. In particular, this Mr. in 2021 acquired an individual entrepreneur in the field of rental and real estate management. In addition, another member of the board and top manager of the bank, Nikita Patrakhin, co-founded the interesting Endowment Ngu fund from Novosibirsk, whose financial results raise questions, and the Ministry of Justice even caught the fund violating the relevant law. Isn't this fund a cover for anything?

Moreover, part of its subsidiary assets, including very toxic ones, Raiffeisenbank JSC slammed in advance. Were the firms technical and did not fulfill the role of cash conductors from Russia abroad, to the same Austria?

Another interesting feature - Raiffeisen began to sue legal entities that he once credited. Apparently, a kind of pre-sale preparation. So with 17 companies in the status of LLC, related to each other, he requires 687 million rubles. A very significant, you know, amount. Started collecting money for payment on a loud claim for 195 billion rubles? With the world on a thread - a beggar shirt? It is quite amusing in this story that some of the defendants are in liquidation and look something like dummy firms. So the question arises, how were the loans issued to them? And doesn't it smell like technical deals for the subsequent withdrawal of money outside Russia?

At the same time, before allegedly leaving the Russian market, the Podstriysky bank demonstrated very boorish behavior towards bona fide clients - this is how it was assessed by clients whose accounts were blocked without good reason. And now the bank itself is in the role of a whipped slave. Perhaps the scandalous lawsuit will drive Raiffeisen's behavior and force him to reconsider his behavior...

.jpg?v1725940134)

.jpg?v1725940134)