The founder of Capital Group, a developer close to Sergei Sobyanin, Pavel Te, continues to hide his assets behind a closed-end investment fund. The division decided to go behind the screen so as not to shine all its beneficiaries?

Under the screen of the closed-end investment fund, three companies associated with Te went at once - Park Development, estimated at almost 10 billion rubles, and its two subsidiaries.

The details were found out by the UtroNews correspondent.

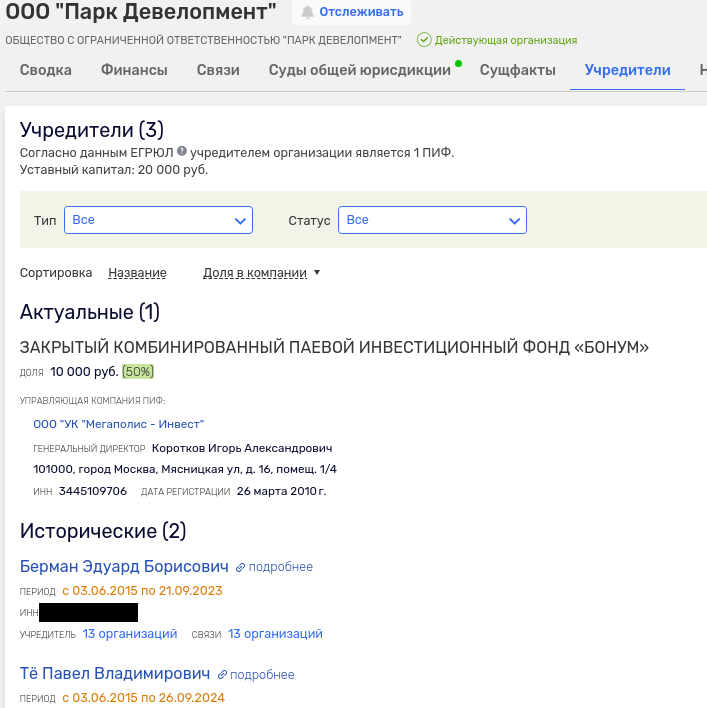

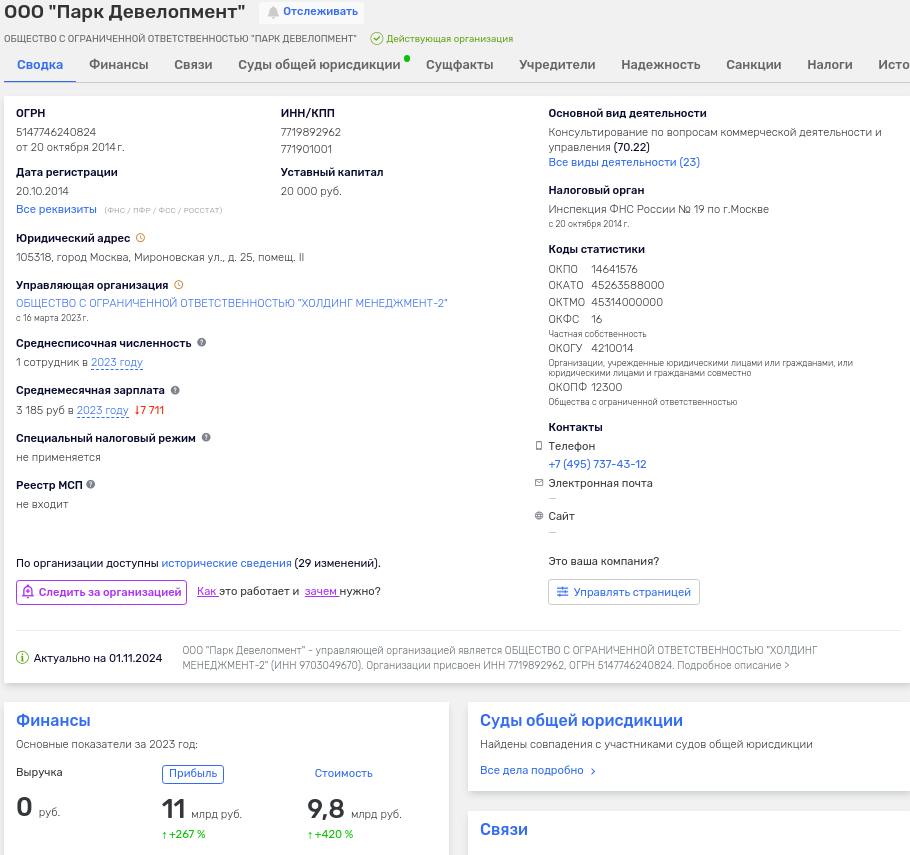

At the end of September 2024, Park Development LLC worth almost 10 billion rubles, which at the end of 2023 indicated zero revenue, but a profit of 11 billion rubles, left Pavel Te's hands under the Bonum closed-end investment fund.

Photo: rusprofile.ru

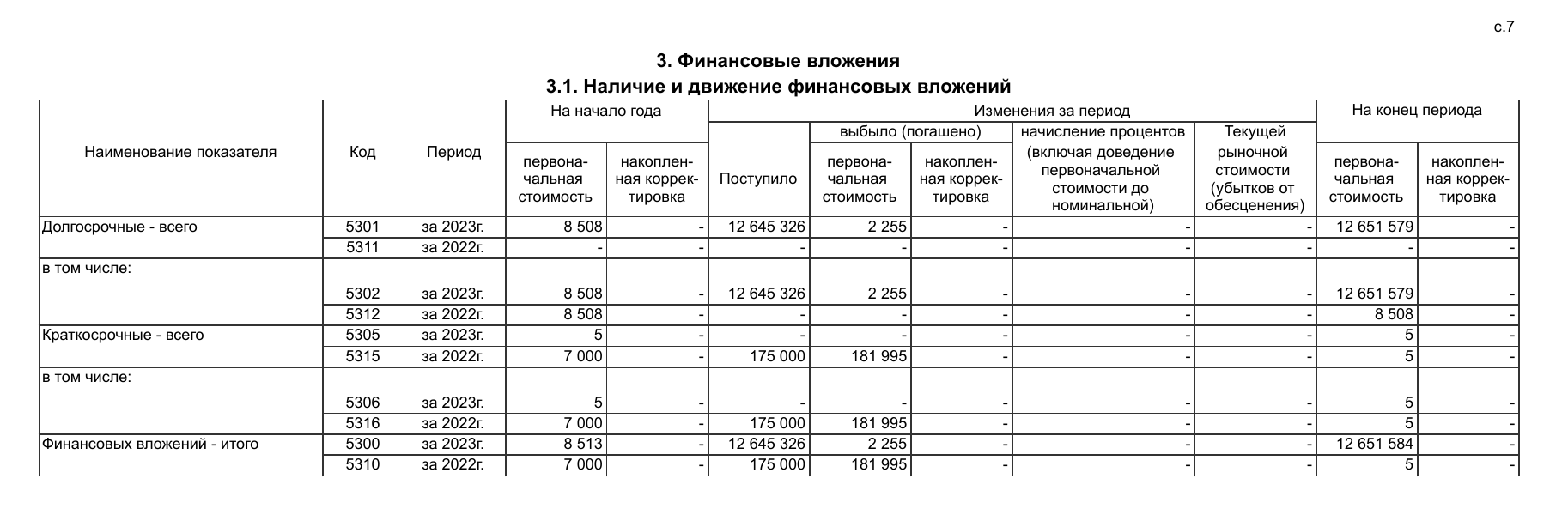

The value of the asset hints to us that the company has some expensive assets. If you look at the LLC report for 2023, then it contains some long-term investments in the amount of more than 12.6 billion rubles.

Photo: bo.nalog.ru

Also, the LLC has two subsidiaries - a 50% stake in Elitstroygroup LLC (purchase and sale of real estate, revenue in 2023 - 2.1 billion rubles) and 50% in LLC UK Litsa (housing management, turnover 158 million rubles).

The remaining subsidiaries before the transfer of ZPIF, Mr. Te brought to his other firms.

An interesting fact: in the Criminal Code "Persons" the owner of 50% is a certain Grigory Grinchenko, who also owns a 70% stake in Kaluga Aerodrome Khatenki LLC (formerly Normandy-Neman Aeroclub).

Elitstroygroup, judging by the materials of the courts, is related to the construction of a skyscraper - the Tricolor residential complex, which was built by Capital Group Te on the street. Rostokinskaya.

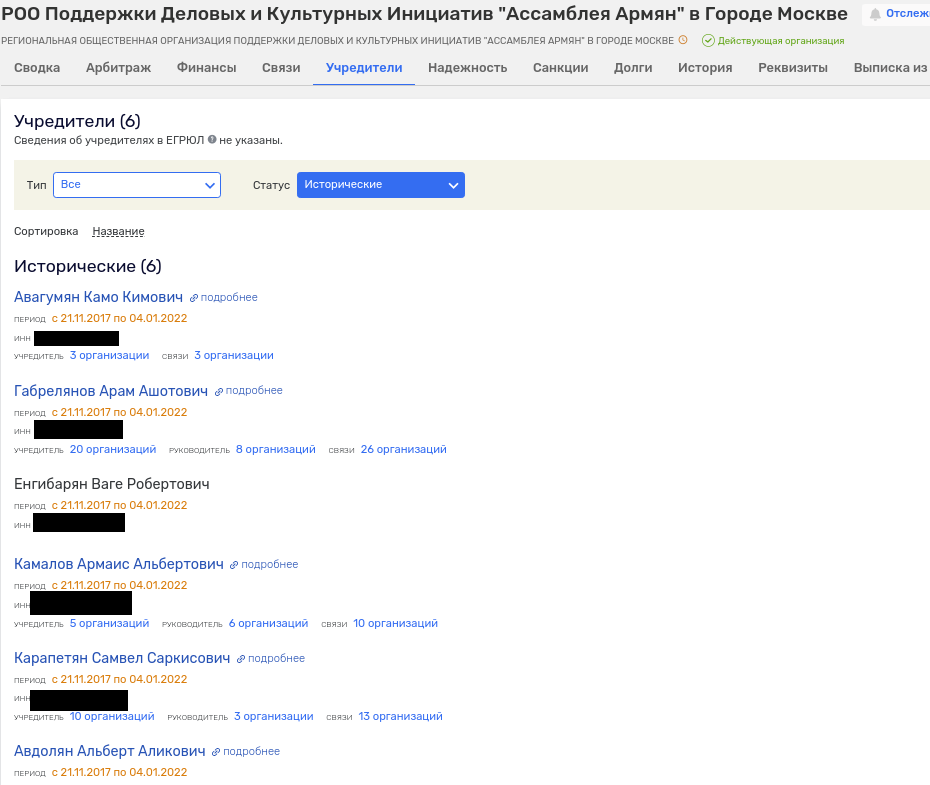

In addition, this construction company, judging by the arbitration base, had a business relationship with a businessman of Armenian origin Kamo Avagumyan. The latter is the namesake of the chairman of the board of directors of the Avilon group of companies and the representative of the Prosecutor General of Armenia in Russia, whose family was associated with the son of ex-Prosecutor General of the Russian Federation Yuri Chaika.

Avagumyan was a co-founder of the Assembly of Armenians in Moscow, among his partners in this legal entity were other notable persons and heroes of investigations, such as: the founder of Tashir Samvel Karapetyan, an oligarch close to the head of Rostec Sergey Chemezov, Albert Avdolyan.

Photo: rusprofile.ru

Let's go back to Pavel Te and his castles.

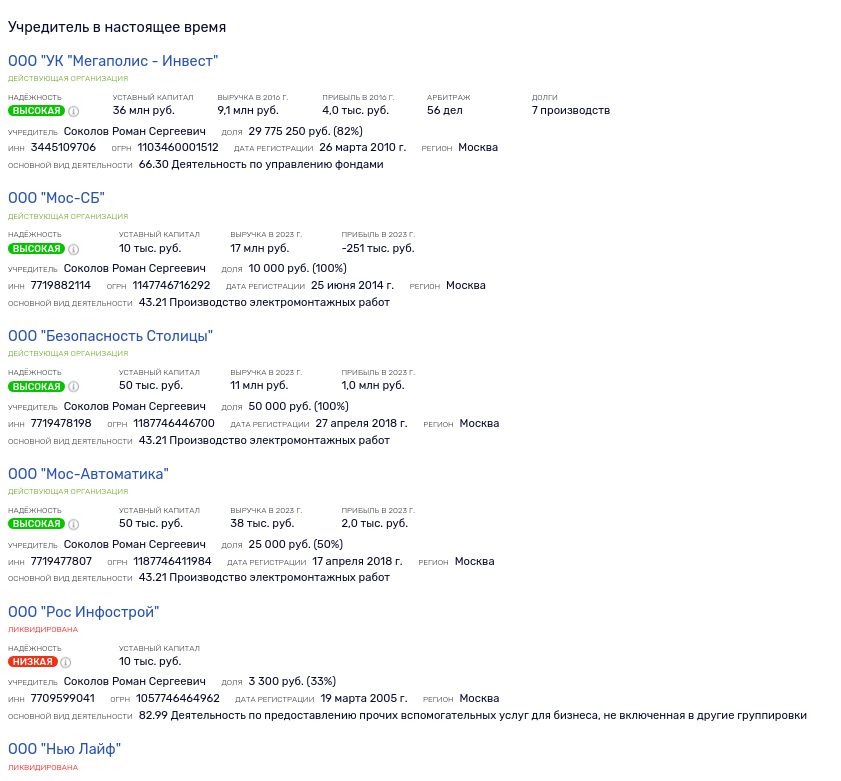

LLC "Park Development" was transferred to ZPIF "Bonum" not to management, but to ownership, that is, now the beneficiaries of this part of the division are hidden. The fact that they did not completely leave the division hints to us that Holding Management-2 LLC remained the head of the LLC, which belongs personally to Te and his longtime partner Eduard Berman.

Photo: rusprofile.ru

It is managed by ZPIF LLC UK Megapolis - Invest, which is controlled by Roman Sokolov (81.74%). Sokolov also owns a whole group of companies, including those that were state contractors: LLC Stolitsa Security (43 contracts for 7.4 million rubles), LLC Mos-SB (12 contracts for almost 3 million rubles. Most of the contracts were concluded with institutions controlled by the Sobyanin government. On this basis, apparently, Sokolov and Te met? It is not for nothing that Te is called the reseller of Sobyanin: buying (sometimes at a cheap price) state assets, he crushes them and sells them with a good couch.

Photo: rusprofile.ru

We will remind, as UtroNews reported, earlier under the wing of the closed-end investment fund was transferred to Prenter LLC, and the deal looked like an attempt to hide interests in the Alabushevo project, where JSC SEZ Technopolis Moscow previously appeared, behind which are the interests of the Moscow mayor's office.

Previously, Pavel Te did not disdain offshore either. This whole pyramid of money boxes surfaced when a businessman began re-registering Cypriot legal entities in the "Russian offshore" - the Kaliningrad region. So, together with business partner Edouard Berman, they re-registered Selcon Holdings LLC, the former Cypriot SELCON HOLDINGS LIMITED. Also, together with SELCON, ICLB Kavadrix Trading and ICLB Watermidow Trading were registered at the same address - the former KAVADRIX TRADING&INVESTMENTS LIMITED and WATERMEADOW TRADING&INVESTMENTS LIMITED.

In general, it turned out that Mr. Te has a good stock of Cypriot legal entities associated with him, and while some relocated Kaliningrad companies show only continuous losses, is everything fine in Cyprus?

It is not for nothing that a certain C.I.T. CAPITAL INVESTMENTS LIMITED, which became the owner of the Watermidow Trading LLC, was left in the jurisdiction of Cyprus.

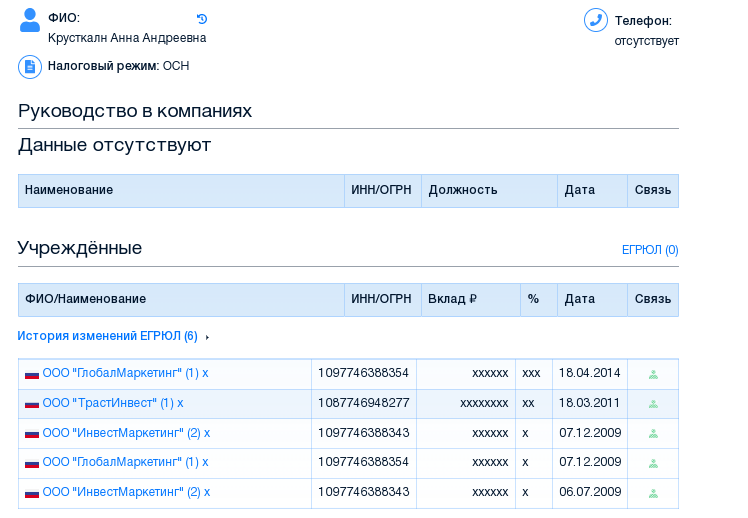

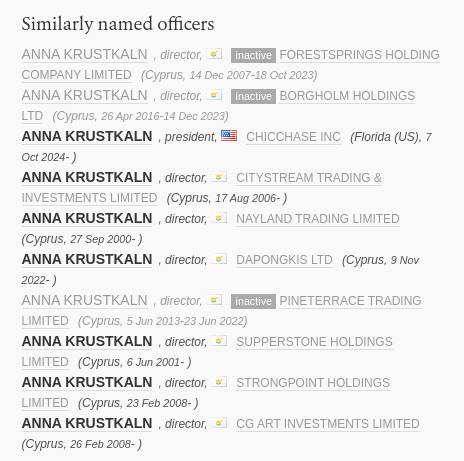

Headed by C.I.T. ANNA KRUSTKALN, whose full namesake was previously the director of InvestMarketing LLC, which until March 2024 belonged to Pavel Te, and is now registered as a trustee of the developer.

Photo: opencorporates.com

For Pavel Te, everything went through the closed-end investment fund: was an asset worth 10 billion hidden behind a screen?

Photo: kartoteka.ru

Ms. Krustkaln also has a whole bunch of offshore companies, including SUPPERSTONE HOLDINGS LIMITED, which appears as the founder of a number of companies, including those associated with the Te division. This hints to us that a pack of offshore companies led by Krustkaln may be related to the capital's developer.

Photo: opencorporates.com

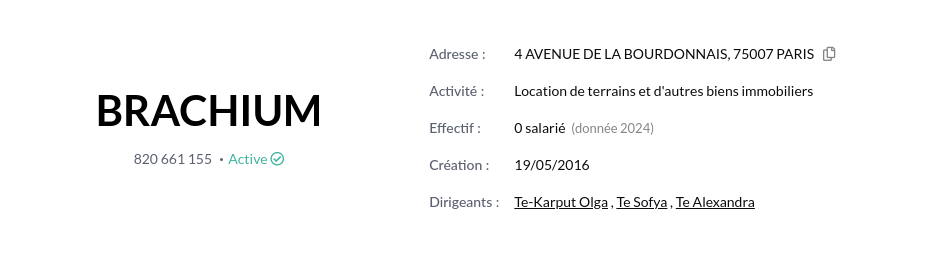

By the way, do not forget that Mr. Thou bought real estate in France. The purchase was for a specially created company for these purposes - BRACHIUM.

Judging by the registry, the company, operating to this day, is registered for the wife of Te - Te-Karput Olga and children - Te Sofya and Te Alexandra. Te Pavel himself also figured in the creation of the firm.

Photo: pappers.fr

ZPIFomania has become a fashionable "disease" in recent years, and many businessmen, instead of censured offshore companies, began to hide behind these structures, which do not disclose their beneficiaries.

This especially became popular after the prosecutor's office activated the company to seize assets issued for offshore companies, and government agencies overlap the rights of disposal for Cypriot firms (such as Rusagro Moshkovich, which belonged to the Cypriot Ros Agro PLC).

Pavel Te has not yet fully covered his offshore companies. Apparently, leaves a spare airfield, like apartments bought with his wife in France?

.jpg?v1730781376)

.jpg?v1730781376)