What and why the money of Russian Railways pensioners was spent, and how they could leave through the Dalniy port.

Sergey Orlov continues to expand the assets of RVM Capital Management Company. On August 28, a deal was closed to transfer to ZPIF RVM Vostok, which belongs to RVM Capital Management Company, Port Dalniy LLC, a coal terminal in the port of Vanino (Khabarovsk Territory).

The task of this asset is the transshipment of coal for its sale in the Asian market, which has become the main sales area for Russia after the closure of Europe.

The UtroNews correspondent understood the situation.

Real seller Avdolyan?

Orlov bought the company from DVFK JSC, which in turn received Port Dalniy LLC from A-Property Invest LLC, where the founder is Albert Avdolyan's uncle Pyotr Avdolyan - the difference in surnames is a mistake of passporters.

DVFK JSC gained control over Port Dalniy LLC in November 2021 and has not conducted commercial activities since then. It seems that Avdolyanov remained in control of the asset, and now the company has simply passed into the possession of Orlov's organization.

Photo: https://nashaarmenia.info/wp-content/uploads/2020/04/755689930914623.jpeg

For Avdolyanov, offshore companies and gasket firms are the norm in commercial activities, therefore, most likely, this businessman, close to the head of Rostec, Sergei Chemezov, sold this organization to Oryol RVM Capital.

The financial situation in the structure is not the best, so RVM Capital will have to make a lot of efforts to clear these Avdolyan stables.

Pension money

Orlov is a former adviser to the ex-head of Russian Railways Vladimir Yakunin and managed to become a serious entrepreneur, leading RVM Capital. Here he was helped by the money of NPF Blagosostoyanie, in which Yakunin was the general director, and Orlov was a member of the board of directors.

This fund by 2013 (the date of freezing the funded pension in the Russian Federation) managed to accumulate about 300 billion rubles (at a rate of 32 units per dollar) due to pension contributions of Russian Railways employees and subsidies from the state monopoly. Naturally, this money was never idle, but was used for commercial purposes, and, possibly, in the interests of their keepers.

Sergey Orlov. Photo: https://babr24.com/?IDE=207970

Yakunin resigned in 2015 due to the fact that one of his sons, Andrei Yakunin, acquired a British passport and moved to live in London. It was with Andrei Yakunin that Orlov led many projects, although his real counterparty was most likely Vladimir Yakunin.

Orlov and Andrei Yakunin actively developed the hotel business, so the Venture Investment and Yield Menegment (VIY) fund was founded, which gained control over many hotels, including the St. Petersburg Baltic. This fact is interesting in that the Baltic under the USSR was located next to the Berezka store and was a legendary place for Leningrad farmers. Orlov and Yakunins remembered their youth and did not forget about this object.

According to this scheme, RVM Capital was also created in Russian Railways in order to control the non-core assets of the state monopoly, that is, everything on which they usually earn money. One of the shareholders of the organization was NPF Blagosostoyanie, which financed Orlov's business with pension money from Russian Railways.

Comrade Vladimir Yakunin

The events of 2015 did not change the situation. Orlov continues to control RVM Capital, which buys assets thanks to the help of NPF Blagosostoyanie. The interests of Yakunin Sr. continue to be somewhere near this organization.

The Forbes wrote in 2014 that Orlov was a relative of Vladimir Yakunin's wife Svetlana, but then denied these words. However, the sediment remained, and there is no smoke without fire. In any case, Yakunin and Orlov have known each other for a long time - for example, on the affairs of the Ozero cooperative from the Leningrad Region.

Vladimir Yakunin. Photo: https://dzen.ru/a/W8WZQb4rNQCug7xf

Interestingly, Yakunin in 2013 lobbied for the preservation of the status of non-profit organizations for NPFs of the Welfare type. The former head of Russian Railways did not like the prospect when the main shareholder, that is, Russian Railways, will be responsible for the deterioration of the position of depositors. Yakunin was not heard and since 2018, Russian Railways has been responsible for the liabilities of Welfare.

Only Orlov's activities were not limited, and it was during these years that RVM Capital began to buy assets with money, followed by NPF Blagosostoyanie.

RVM "Capital" in the real sector

The scale of RVM Capital's activities even increased after Yakunin's resignation. Orlov began to buy up assets. In 2018, the organization entered the Sukhodol coal port project in Primorye. The company is promoting great interest in the HSR project and claims to build a section of the highway between Yekaterinburg and Chelyabinsk.

At the same time, RVM Capital began its interest in Russian ports. Of the latest shares, in addition to the deal with Avdolyans on the Vanino coal terminal, the July purchase of a cargo terminal in the Kavkaz port should be named. The asset was also registered with ZPIF RVM Vostok.

Photo: Rusprofile.ru

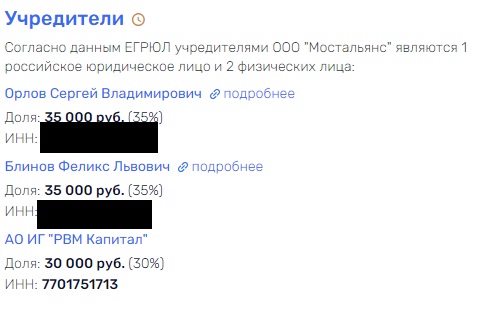

Orlov himself does not hesitate to use RVM "Capital" for personal purposes. Today, this employee is the founder of Mostalliance LLC, where his partner, in addition to Felix Blinov, is JSC IG RVM Capital. This organization conducts almost no activity, and the purpose for which it was created in 2017 is unclear. This can be both the receipt of state orders and the withdrawal of money from the same "RVM Capital."

The company's financial indicators are small, but it is a participant in two litigation in the amount of 257.5 million rubles, in one of them the Ministry of Transport of the Moscow Region is the defendant. It is headed by Evgeny Alekseev, who is also the general director of Operator Company JSC, which is engaged in investing in securities.

Scratch my back and I will scratch yours

In addition to Mostalliance LLC, several organizations have been registered at RVM Capital. One of them is RG-Development, which was founded by Arkady Rotenberg and bought out by Orlov's structure in 2019. The company is included in the Top-20 developers, and Rotenberg himself left it due to sanctions. Given the connections between Yakunin and Rotenberg, RVM Capital can perform the functions of a management structure here.

The participation of RVM "Capital" in LLC "Specialized developer" Seliger Park "is indicative. Orlov's organization was the founder there from 2019 to 2020, and now this function is performed by LLC Specialized Developer Seliger Invest, which in turn belongs to LLC Financial Solutions, another daughter of NPF Blagosostoyanie. However, this is not all in this scheme.

Another beneficiary of Seliger Park is Absolut Bank, which is also close to Yakunin and Orlov. In 2020, the ex-head of this credit institution Andrei Degtyarev bought more than 20% of Andrei Yakunin's Luxembourg company VIY Managers.

So, the former head of Russian Railways, through his friend Orlov, continues to use the money of the state monopoly. It is a pity only for pensioners of Russian Railways, who from the activities of Orlov and Yakunins may lose their insurance savings.

.jpg?v1724992759)

.jpg?v1724992759)